DOWNLOAD: CLFD Q3 Fiscal 2011 Earnings Release FINAL

Year-Over-Year Revenue Growth Continues Establishing Record Quarter

| Revenues: | $10.1 million, up 49% from third quarter fiscal 2010 |

| Gross profit: | $4.3 million, up 66% from third quarter fiscal 2010 |

| Net income: | $1.3 million, up 103% from third quarter fiscal 2010 |

| Net income per share: | $0.11 per basic share |

Minneapolis, MN, July 28, 2011 – Clearfield, Inc. (Nasdaq:CLFD), the specialist in fiber management and connectivity solutions, today announced results for its third quarter of fiscal 2011, which ended June 30, 2011.

Revenue for the third quarter of fiscal 2011 was $10,125,000 in comparison to $6,778,000 for the third quarter of fiscal 2010, an increase of 49%. Gross profit was $4,319,000 for the third quarter of fiscal year 2011 in comparison to $2,603,000 for the prior year third quarter, an increase of 66%. Gross margin for the third quarter of fiscal year 2011 was 42.7%, up 4.3% for the comparable quarter of fiscal 2010. Operating expenses were $3,032,000 for the third quarter of fiscal year 2011, an increase of 52% from $1,993,000 in the same quarter of fiscal year 2010. Net income increased $649,000, or 103%, to $1,278,000 for the quarter ended June 30, 2011, compared to $629,000 for the quarter ended June 30, 2010.

Year to Date Performance

Revenue for the nine month period ending June 30, 2011 was $24,491,000 in comparison to $16,446,000 for the comparable period in fiscal 2010, an increase of 49%. Gross profit was $10,178,000 for the nine month period ending June 30, 2011, in comparison to $6,038,000 for the comparable period in fiscal 2010, an increase of 69%. Gross margin for the period was 41.6%, up from 36.7% in the comparable period in fiscal 2010. Operating expenses were $7,860,000 for the nine month period, an increase of 37% from the comparable period in 2010. Net income was $2,311,000 for the nine month period ended June 30, 2011, compared to a $361,000 in the first nine months of 2010.

Orders in backlog as of June 30, 2011 totaled $4,061,000, an increase of $382,000 over the backlog for the previous quarter ending March 31, 2011 and an increase of $2,198,000 over the backlog for the quarter ending June 30, 2010.

Commentary- Cheryl Beranek, President & CEO of Clearfield

“We are very pleased with our 50% revenue growth for this quarter and year-to-date period. Our success is based upon increasing acceptance of our FieldSmart® fiber management architecture and FiberDeepTM fiber connectivity solutions throughout our customers’ network. The product line continues to earn acceptance from small and large accounts alike. Networks, such as those at Venture Communications in South Dakota with a thousand access lines to Cincinnati Bell’s network of 150,000 fiber lines and growing, demonstrate the scalability of our platform. Core to our success is the personal relationships we are building with the engineers responsible for these networks, but we are also pleased with the strong reseller partnerships we are building with distributors and original equipment manufacturers that enable us to reach an even broader base of business.

“While the projects funded through the American Recovery and Reinvestment Act’s stimulus program are an important part of our strategic plans, the business generated under this program remains a minority of our revenue for the third quarter of 2011.

“Engineering and product management remains aggressive with new product initiatives. Last quarter’s introduction of the FieldSmart Small Count Delivery (SCD) Case showcases the innovation of our product development efforts. This product line is changing the way drop cable media is deployed introducing Clearfield to expanding market opportunities as we bring fiber closer and closer to the home.

”We are continuing to increase our manufacturing capacities, with additions in production headcount, capital equipment and facility build-outs. Our team of production and manufacturing personnel is doing a stellar job of responding to our accelerating growth demands while improving our productivity levels. Key to our gross margin growth is continual improvements in the manufacturing process which are reducing our overall cost of production. Teamed with supply partnerships that ensure the availability of our product components, we remain confident that we can control our growth in required inventory while meeting the increasing demand being generated by our sales and marketing teams.

We are continuing to reduce the average time between customer order and product delivery. Delivering our product line with a guaranteed delivery date is winning the Company business and enabling our customers to maintain deployment schedules that reduce installation costs.

“The increase in operating expenses over the prior year reflects our investments into building our sales team, along with higher compensation expenses associated with the achievement of revenue and income objectives. Over the upcoming months, we will continue to invest in personnel with additions in our sales, marketing and engineering talent. While it will be crucial for us to remain focused, we are confident that we can leverage our value-based business model into new accounts within our foundational business as well as emerging revenue-generating market segments.”

About Clearfield, Inc

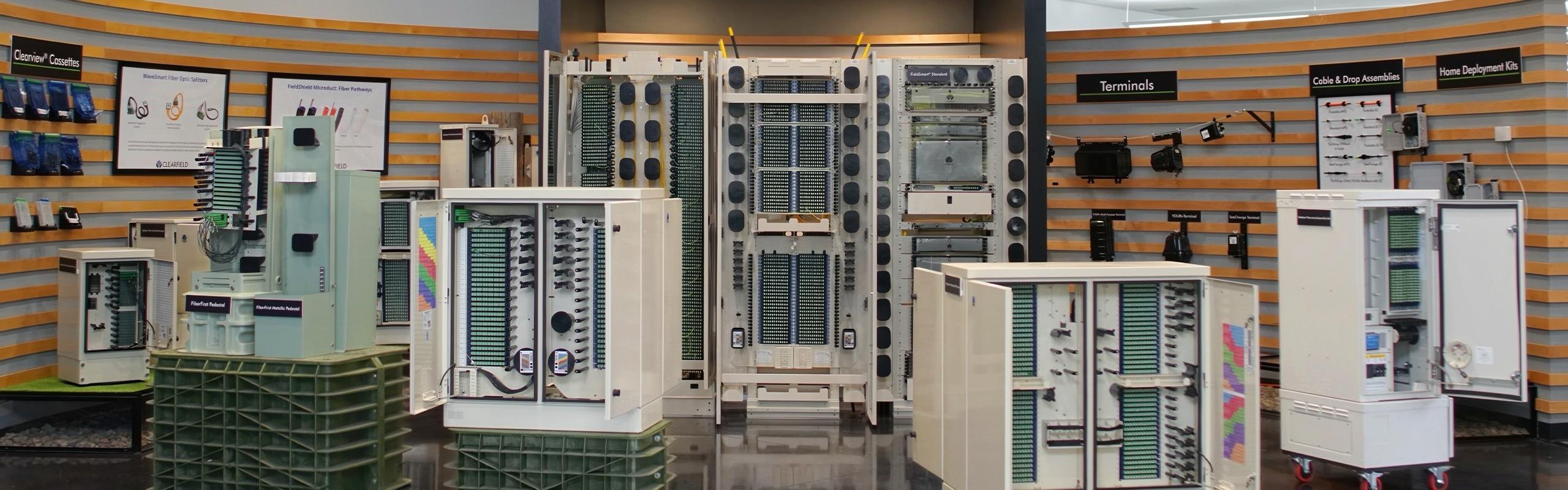

Clearfield, Inc. sets the standard for fiber performance with FiberDeep while lowering the cost of broadband deployment with the FieldSmart fiber management platform and the CraftSmart OSP enclosure system. FieldSmart is the only fiber management platform to be designed around a single architecture – the Clearview Cassette and xPAK— for the inside plant, outside plant and access network. Scaling from 1 to 1728 ports, FieldSmart supports a wide range of panel and cabinet configurations, densities, connectors and adapter options, and are offered alongside an assortment of passive optical components. CraftSmart is the industry’s only field enclosure system optimized for fiber deployment. FiberDeep is a new class of fiber patch cords that guarantees performance at .2dB insertion loss — fully half that of the industry standard. Clearfield provides a complete line of fiber and copper assemblies for inside plant, outside plant and access networks. “FiberDeep” “FieldSmart,” “CraftSmart OSP,” “Clearview Cassette” and “xPAK” are proprietary or registered trademarks and trade names of Clearfield, Inc. Clearfield is a public company traded on NASDAQ: CLFD.

Forward-Looking Statements

Forward-looking statements contained herein are made pursuant to the safe harbor provisions of the Private Litigation Reform Act of 1995. These statements are based upon the Company’s current expectations and judgments about future developments in the Company’s business. Certain important factors could have a material impact on the Company’s performance, including, without limitation the effect of the significant downturn in the U.S. economy on Clearfield’s customers; the impact of the American Recovery and Reinvestment Act or any other legislation on customer demand and purchasing patterns; cyclical selling cycles; need to introduce new products and effectively compete against competitive products; dependence on third-party manufacturers; limited experience in manufacturing; reliance on key customers; rapid changes in technology; the negative effect of product defects; the need to protect its intellectual property; the impact on its financial results or stock price of its ability to use its deferred tax asset, consisting primarily of net operating loss carryforwards, to offset future taxable income; the valuation of its goodwill and the effect of its stock price, among other factors, on the evaluation of goodwill; and other factors set forth in Clearfield’s Annual Report on Form 10-K for the year ended September 30, 2010 as well as other filings with the Securities and Exchange Commission. The Company undertakes no obligation to update these statements to reflect actual events.

CLEARFIELD, INC.

CONDENSED STATEMENTS OF OPERATIONS

UNAUDITED

| Three Months Ended | Nine Months Ended | ||||||||||

| June 30 | June 30 | ||||||||||

| 2011 | 2010 | 2011 | 2010 | ||||||||

| Revenues | $ | 10,124,665 | $ | 6,778,193 | $ | 24,490,898 | $ | 16,445,626 | |||

| Cost of sales | 5,805,914 | 4,174,998 | 14,312,455 | 10,407,347 | |||||||

| Gross profit | 4,318,751 | 2,603,195 | 10,178,443 | 6,038,279 | |||||||

| Operating expenses | |||||||||||

| Selling, general and administrative | 3,076,388 | 1,992,576 | 7,904,006 | 5,746,913 | |||||||

| Gain on disposal of assets | (44,352) | – | (44,352) | – | |||||||

| 3,032,036 | 1,992,576 | 7,859,654 | 5,746,913 | ||||||||

| Income from operations | 1,286,715 | 610,619 | 2,318,789 | 291,366 | |||||||

| Other income (expense) | |||||||||||

| Interest income | 26,604 | 36,491 | 83,065 | 112,125 | |||||||

| Interest expense | – | – | – | (820) | |||||||

| Other income | 10,000 | 11,498 | 25,500 | 35,850 | |||||||

| 36,604 | 47,989 | 108,565 | 147,155 | ||||||||

| Income before income taxes | 1,323,319 | 658,608 | 2,427,354 | 438,521 | |||||||

| Income tax expense | 45,489 | 29,595 | 115,879 | 77,559 | |||||||

| Net income | $ | 1,277,830 | $ | 629,013 | $ | 2,311,475 | $ | 360,962 | |||

| Net income per share: | |||||||||||

| Basic | $0.11 | $0.05 | $0.19 | $0.03 | |||||||

| Diluted | $0.10 | $0.05 | $0.18 | $0.03 | |||||||

| Weighted average shares outstanding: | |||||||||||

| Basic | 12,097,670 | 11,995,331 | 12,054,868 | 11,987,793 | |||||||

| Diluted | 12,829,497 | 12,437,853 | 12,738,794 | 12,460,069 |

CLEARFIELD, INC.

BALANCE SHEETS

UNAUDITED

| June 30, 2011 | September 30, 2010 | ||||

| Assets | |||||

| Current Assets | |||||

| Cash and cash equivalents | $ | 8,229,087 | $ | 5,285,719 | |

| Short-term investments | 3,141,000 | 1,764,868 | |||

| Accounts receivable, net | 3,681,152 | 3,244,379 | |||

| Inventories | 2,197,569 | 1,512,306 | |||

| Other current assets | 254,417 | 129,079 | |||

| Total current assets | 17,503,225 | 11,936,354 | |||

| Property, plant and equipment, net | 910,422 | 1,273,107 | |||

| Other Assets | |||||

| Long-term investments | 2,216,000 | 3,236,163 | |||

| Goodwill | 2,570,511 | 2,570,511 | |||

| Deferred taxes –long term | 2,083,757 | 2,145,362 | |||

| Other | 176,368 | 176,368 | |||

| Patents | 23,099 | 23,099 | |||

| Total other assets | 7,069,735 | 8,151,503 | |||

| Total Assets | $ | 25,483,382 | $ | 21,360,961 | |

| Liabilities and Shareholders’ Equity | |||||

| Current Liabilities | |||||

| Accounts payable | 1,301,687 | 1,188,261 | |||

| Accrued compensation | 2,110,037 | 765,181 | |||

| Accrued expenses | 91,562 | 82,867 | |||

| Total current liabilities | 3,503,286 | 2,036,309 | |||

| Commitment and contingencies | – | – | |||

| Deferred rent | 67,386 | 78,585 | |||

| Total Liabilities | 3,570,672 | 2,114,894 | |||

| Shareholders’ Equity | |||||

| Common stock | 121,365 | 120,153 | |||

| Additional paid-in capital | 52,942,990 | 52,589,034 | |||

| Accumulated deficit | (31,151,645) | (33,463,120) | |||

| Total shareholders’ equity | 21,912,710 | 19,246,067 | |||

| Total Liabilities and Shareholders’ Equity | $ | 25,483,382 | $ | 21,360,961 |